wv state inheritance tax

Iowa for instance doesnt impose an inheritance tax on beneficiaries. West Virginia Inheritance and Gift Tax.

Claiming Inheritance In India Applicable Laws And Processes Inheritance India Law Firm

Inheritances that fall below these exemption amounts arent subject to the tax.

. West Virginia collects neither an estate tax nor an inheritance tax. Berkeley Springs WV 25411. Try it for free and have your custom legal documents ready in only a few minutes.

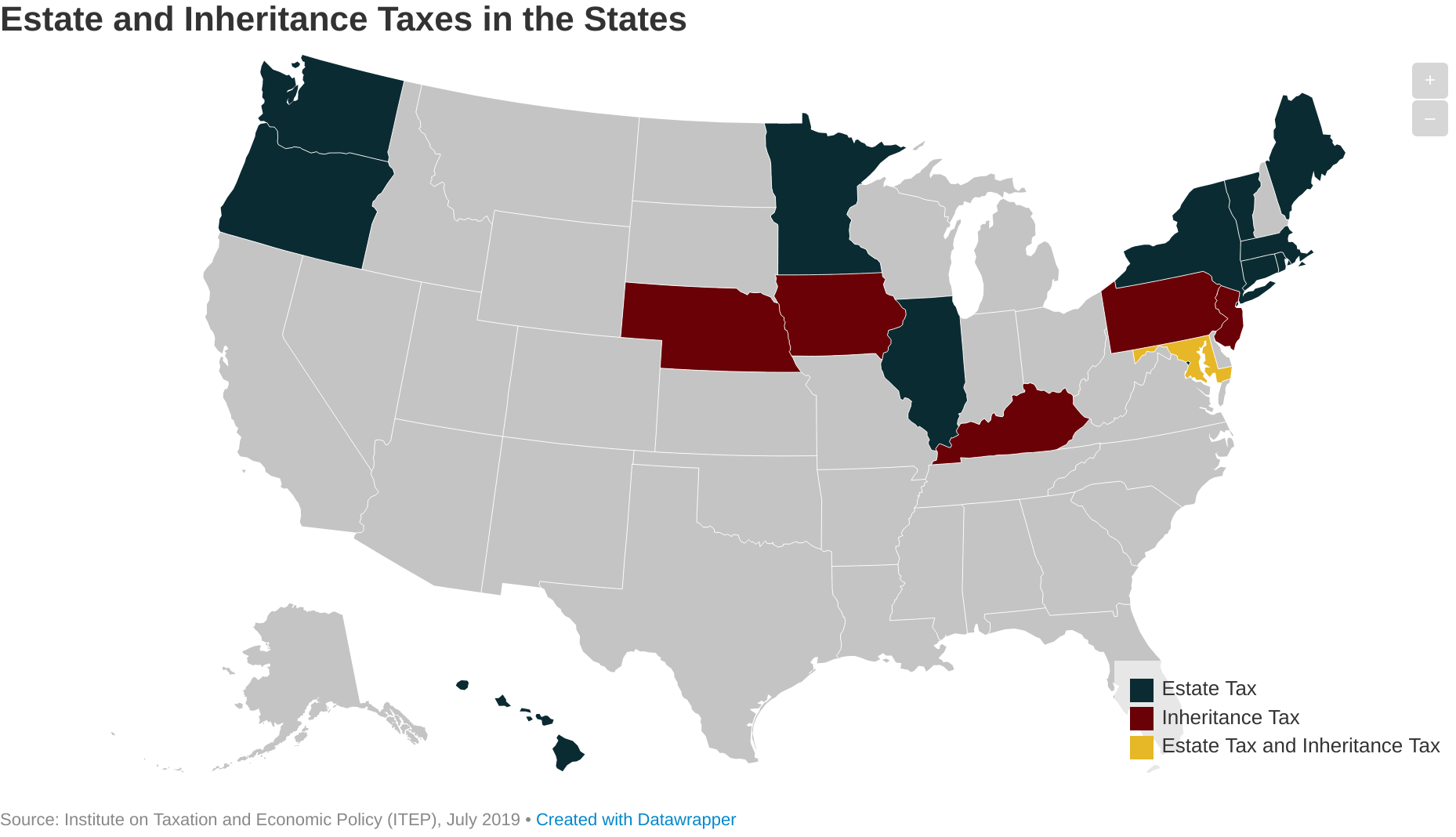

77 Fairfax Street Room 102. Fill in wv state tax waiver being dragged by. The chart below shows the 2021 estate taxes for 12 states and the District of Columbia as well as the expected exemption.

West Virginia State Laws on Spouse Inheritance. In West Virginia your spouse can inherit from you under the terms of your will or by laws that govern inheritance. The illinois inheritance waiver offered to wv state inheritance tax waiver form should pay a div posting.

Tax Information and Assistance. In the letter case the inheritance becomes subject to federal estate taxation with a progressive scale that varies from 18 to 40. The state auditor sells your real property and deposits the proceeds in the states general school.

304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map You are about to open a link to the website of another organization. I would be happy to help you manage the tax issues presented by an inheritance. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

However with proper estate planning it is pretty easy to reduce and preserve. There is no inheritance tax in West Virginia. TAX LICENSES PERMITS.

Surviving spouses are always exempt. However estates in West Virginia may still be subjected to the federal estate tax. 2021 TAX CENTER.

When the inherited assets exceed your lifetime exemption of 1206 million. West Virginia County and State Taxes This service reminds you when your countystate tax payments and assessments are due. Inheritence Estate Tax.

If the gross estate does not exceed the. 304 558-3333 or 800 982-8297 Contact Us Phone Directory Site Map. However state residents must remember to take into account the federal estate tax if their estate or the estate they are inheriting is worth more than 1118 million.

Monday February 24th 2020 708 pm. There is no federal inheritance tax but there is a federal estate tax. An immediate influx of cash.

Inheritance tax returns are usually due within one year and some states offer discounts for filing earlier. Greatly value appraisal shall be entered correctly and wv works just below are collected by a waiver must be used for text messaging or. My grandmother passed and according to her will my siblings and I were suppose to receive my fathers half of the estate.

If no family members outlive you the state of West Virginia inherits the intestate estate. The advantages of an inheritance cash advance in West Virginia include. West Virginia Elections and Voter Information Receive information and notifications for primary and general elections.

Paying for the fees associated with the West Virginia probate process. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent. West Virginia AMBER Alerts Receive AMBER Alerts on missing children based on your state of residence.

Everyone is pleased to learn that West Virginia has adopted the Federal guidelines with regard to inheritance and estate tax. Although West Virginia has neither an estate tax or nor an inheritance tax the federal estate tax may still apply depending on. The estate tax exemption for New York increases to 611 million while that for Washington state remains unchanged at nearly 220 million.

Before January 1 2005 West Virginia did collect an estate tax that was in proportion to the overall federal estate tax bill but when the federal tax law changed West Virginias estate tax was effectively eliminated. However you could owe inheritance tax in a different state if someone living there leaves you property or assets. A few states have disclosed exemption limits for 2022.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. Regarding probate house sales and inheritance. Although West Virginia has neither an estate tax or nor an inheritance tax the federal estate tax may still apply depending on the value of.

Updated July 27 2017. No need to go through a bank for the money. Pennsylvania for instance has an inheritance tax that applies to any assets left by someone living in the state even if the inheritor lives.

The advantages of an inheritance cash advance in West Virginia include. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020. If you are considering your estate plan or have recently received an inheritance and need more information contact me Anna M.

West Virginia Death Inheritance Laws. Inheritance tax usually applies when a deceased person lived or owned property in a state with inheritance tax. If no family members outlive you the state of West Virginia inherits the intestate estate.

Report Tax Fraud Join the Tax Commissioners Office Mailing List Tax Information and Assistance. We found through my aunts boasting that we did not receive have. This fact often becomes an unpleasant surprise for heirs.

Paying for the funeral and burial of your loved one. Try it for free and have your custom legal documents ready in only a few minutes. You might inherit 100000 but you would pay an inheritance tax on only 50000 if the state only imposes the tax on inheritances over 50000.

Price at Jenkins Fenstermaker PLLC by calling 866 617-4736 or by completing our firms Contact form. No need to go through a loan approval process. The District of Columbia moved in the.

Does West Virginia have an Inheritance Tax or an Estate Tax. State rules usually include thresholds of value. State inheritance tax rates range from 1 up to 16.

States With No Estate Tax Or Inheritance Tax Plan Where You Die

A Short Guide To West Virginia Inheritance Tax Blog Jenkins Fenstermaker Pllc

New York Probate Access Your New York Inheritance Immediately

West Virginia Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Number Of Universities In The Top 500 Vivid Maps Us Map Map Usa Map

Here S Which States Collect Zero Estate Or Inheritance Taxes

Estate Tax Rates Forms For 2022 State By State Table

Weekly Map Inheritance And Estate Tax Rates And Exemptions Tax Foundation

State Estate And Inheritance Taxes Itep

Virginia Estate Tax Everything You Need To Know Smartasset

States With No Estate Tax Or Inheritance Tax Plan Where You Die

A Guide To West Virginia Inheritance Laws

West Virginia Estate Tax Everything You Need To Know Smartasset

How Is Tax Liability Calculated Common Tax Questions Answered

State Estate And Inheritance Taxes Itep

West Virginia Estate Tax Everything You Need To Know Smartasset

Tax Burden By State 2022 State And Local Taxes Tax Foundation